Understanding Bond Prospectus

In the pool of investment opportunities in the capital markets, treasury bonds have been promising income generators and reliable choice for risk-averse investors seeking consistent returns on reduced risk. This write-up delves into the intricacies of the bond prospectus of both infrastructure(IFB) and fixed income (FXD) treasury bonds, shedding light on the terms used in the bond prospectus for clear understanding.

It’s worth knowing these two bond prospectus are issued at different times however, the structures are almost indistinguishable. The fixed income one is issued every month while infrastructure one on unpredictable months.

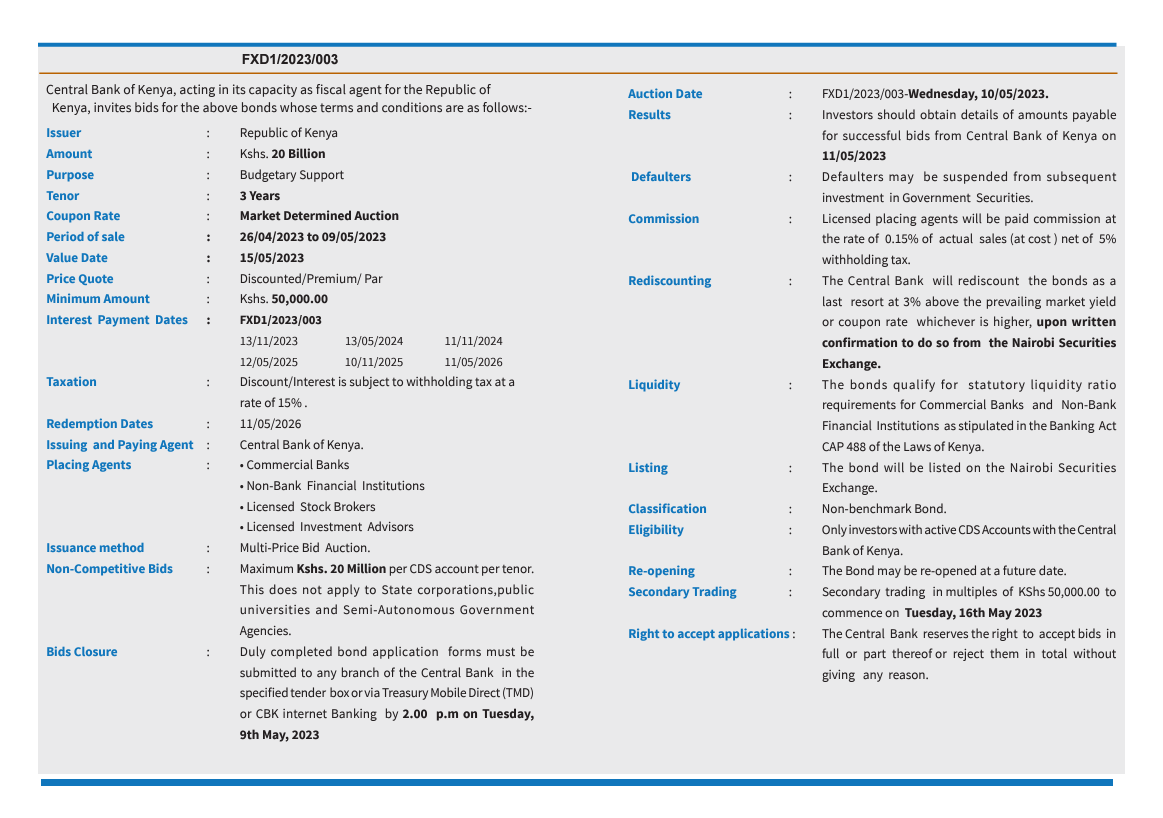

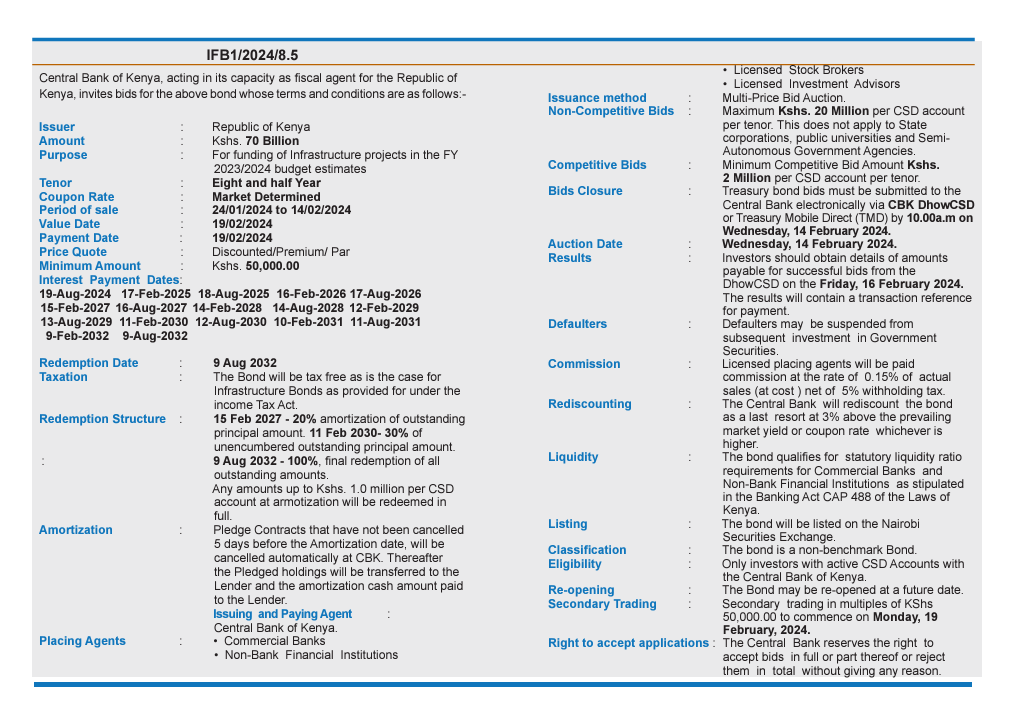

Examples of Bond Prospectus

Disclaimer: Investing in treasury bonds carries risks, and past performance (empirical data) is not indicative of future results. Make sure to do your own due diligence and if you prefer can consult with a financial advisor to guide you before making any investment decisions. Be sure to confirm you are dealing with a registered and approved financial advisor and don’t share your personal details; security details included.

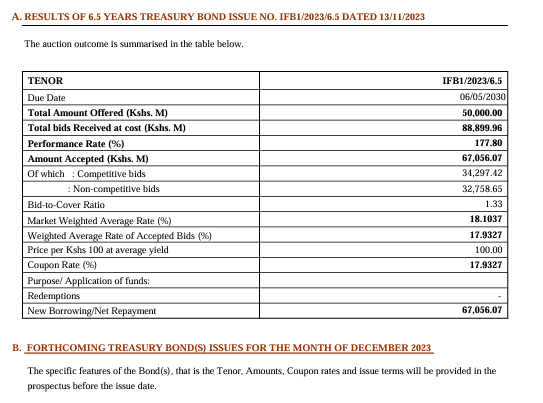

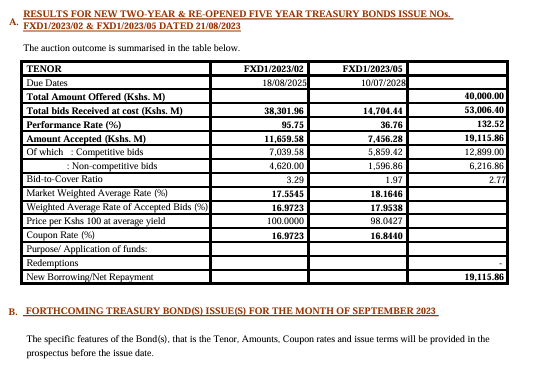

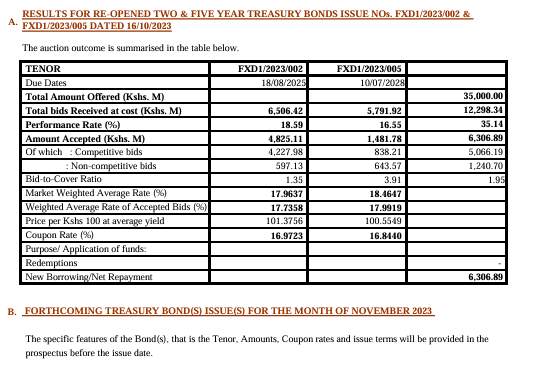

Examples of Bond Results

Let’s simplify the bond prospectus jargon

We’ll look at the important features for an investor to know as they are deciding to invest in Treasury bonds.

- Issuer: All treasury bonds are issued by the Republic of Kenya through Central Bank of Kenya.

- Amount: The bond amount which Republic of Kenya is looking to raise from investors.

- Purpose: Every issued bond has a purpose. Infrastructure bonds fund development projects while fixed income bonds fund different Government responsibilities.

- Tenor: The duration of a bond. The period between issuance of a bond and its maturity.

- Coupon rate: The annual interest rate which investors will receive over the bond’s life. The rate is a percentage of the bond’s face value/accepted bids. Usually the coupon rate is market determined and announced once all bids have been received and analysed, after period of sale.

- Period of sale: A defined time when investors can place their bids on the issued bond.

- Value date: The day investors should make the bond payment after results are released. Most times by 2:00 pm on the day all payments must have been done. Some banks require investors to fill authorisation forms for the payments (RTGS). The transaction reference for payment is sent to registered email address and/or text message (as per communication preference(s) selected when opening DhowCSD account)

- Payment date: Same as value date.

- Price quote: Bonds can be issued at a discount/premium/par. When an investor places a bid, they do so in round figures (multiples of KES 50,000). After results are released, for non-competitive bids, CBK state if investors will pay the bid amounts they placed or the bond will be discounted. All these is market determined. For competitive bids, the yields investors quote when placing bids will be the determinant of their amount to pay, whether at a discount/premium.

- Minimum amount: The least amount an investor can bid. It can vary depending on the issued bond but most times either KES 50,000 or KES 100,000.

- Interest payment dates: The exact day when investors receive coupons/interests. Investors receive coupons after every six months. The coupon amount is credited into the investors’ registered bank accounts or can be reinvested in purchasing other bonds.

- Redemption date: The day a bond matures.

- Taxation: Infrastructure bonds (IFBs) are tax free as provided under the Income Tax Act. Fixed income bonds (FXDs) are subject to withholding tax of 15%.

- Redemption: Bonds can be paid off either in full at maturity or through amortisation. Investors still receive coupons. Bond amortisation happens at specified dates in the prospectus and portions of the outstanding principal amount specified. Amortisation is common with infrastructure bonds. Investors who have up to Kes 1 million would have all their invested amount redeemed in full at amortisation.

- Placing agents: The listed entities are the recognised and acceptable placing agents for bond bids. Be careful not to be scammed!

- Issuance method: The auction method allows for investors to place bids of different amounts hence defined as multi-price bid auction.

- Bids closure: The deadline for placing bids, usually the time and day is specified. Make sure you meet the deadline; avoid last minute placements.

- Results: The day of bond auction results are released on the specified date. Investors also receive communication of bid confirmation followed by transaction reference for payment. Investors should then ensure they make their payments. The amount to be paid will be specified in an email or text depending on results; can be at par (same amount as bid), discounted (discount rate specified in results or if it’s a competitive bid) or at a premium (rate specified in results or if it’s a competitive bid).

- Non-competitive bids: Investors only specify the amount they want to bid. The interest rate/coupon rate is determined based on average accepted bids. Maximum bid amount is specified, most times it’s Kes 20 million.

- Competitive bids: Investors specify the yield they prefer to purchase the bond. If investor’s specified yield is greater than coupon rate, they get the bond at a discount; if yield is less than coupon rate, they get the bond at a premium; if yield is equal to coupon rate, investor gets bond at par value. A minimum bid amount is specified, most times it’s Kes 2 million.

- Secondary trading: Once the initial public offering (IPO) of the bond is completed (in primary market), the bonds are then traded in the secondary market; there are extra charges, spend more than you would in the IPO, difficult to find a good deal etc.

I have tried to put together the common terms necessary for investors to know. Remember, to invest in bonds you need to have a DhowCSD account. Link to user guide and other resources: DhowCSD